The Rental Decade

Praxis Newsletter – April 2011

If the 2000s were known as the bubble decade, then the 2010s may as well be known as the rental decade.

Demand for rental properties may well outstrip supply over the next five years.

According to David Crowe, Chief Economist for the National Association of Homebuilders (NAHB), construction of 133,000 new multifamily units are being forecast for 2011—far short of the projected demand of 275,000 units. Between 2005 and 2009, 1.2 million young adults “coupled up” as the economy contracted, either moving back home with parents or sharing rentals with friends.

Now with the economy improving, they are once again moving out on their own.

Between 2007 and 2014, it is estimated that 8 million homeowners will lose their homes to foreclosures and move into rentals. Furthermore, lenders for home loans have tightened their underwriting requirements making it more difficult to qualify for a home loan.

With the economy improving and job creation accelerating, the demand for rentals is increasing; and with millions of households moving from owning to renting, rental property values are on the rise.

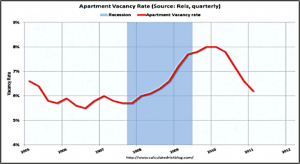

As the chart above shows, U.S. apartment vacancy rates hovered around 6% before the recession.

During the recession, vacancy rates climbed, topping out at 8% at the end of 2009.

Then, starting with the spring of 2010, rental/apartment demand picked up and has now fallen back, close to pre-recession levels.

Over the next two years, vacancy rates are projected to fall even further. Along with the falling vacancy rates, rents have already started to rise. This rise should accelerate over the next two years.

Currently, there is a rare opportunity to purchase rental properties in some of the nation’s strongest rental markets significantly below replacement costs.

Praxis Capital has formed two limited partnerships to purchase single family homes for rentals in Northern California and multifamily properties in the three major Texas metropolitan areas of Austin, Houston and Dallas.

We believe both of these partnerships are well positioned to profit on the significant increase in demand and value of rental properties.