The Case for Real Estate in Your Portfolio

Experts Suggest a Well Diversified Portfolio of Non-correlated Assets

“The average person has almost no exposure to alternatives,” said David Saunders, founding managing director of Franklin Templeton K2 Investments.

Institutional investors see alternatives as a risk reducer while retail investors view them as high risk, he said.

Roughly 29% of institutional investor assets under management are in alternative vehicles compared to under 2% for retail investors.

Saunders urged increased education to help the retail customers get closer to the institutional point of view.

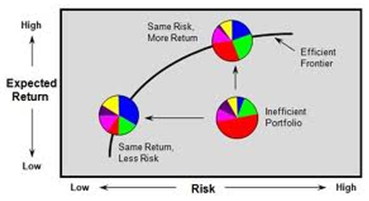

Modern Portfolio Theory

Modern Portfolio Theory (MPT), designed by Nobel laureate Harry Markowitz in 1952, is an investing method where the investor attempts to take minimal level of risk to capture maximum level of returns for a given portfolio of investments. For the next several charts, the nearer to the top of the graph, the higher the return. The more to the right side of the graph, the more the potential for dramatic swings in valuation. The ideal position for your portfolio is to be somewhere on the “Efficient Frontier”.

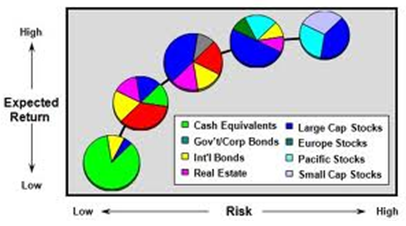

The chart below shows the historic relationships between ‘Rate of Return’ and associated ‘Risk’ for different asset classes.

MPT suggests that you can maximize your return and minimize your risk by diversifying your portfolio to include low or non-correlated assets in your portfolio. Depending on your risk tolerance (stomach for wild swings in value), different combinations will help you to achieve maximum “efficiency”.

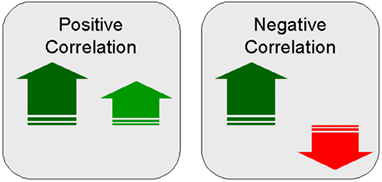

Correlation refers to the percentage chance that two (or more) assets will move in lock-step with each other. A sample of non-correlated items could be ice cream and hot chocolate. When it’s snowing, you want hot chocolate and when it’s 100 degrees outside, it’s ice cream!

Below is a sample of possible portfolio components which may help you to achieve the goals of moving closer to the “Efficient Frontier”. By combining these asset classes, an investor is able to minimize risk to achieve a desired result…or to achieve a maximum return given the acceptable level of risk one is willing to take.

The Case For Including Private Real Estate in Your Portfolio

Because private real estate has low or negative correlations with stocks, bonds and public REITS, it may help smooth return fluctuations within a traditional portfolio of stocks and bonds. Low correlations with other asset classes suggest that, in general, private real estate returns do not move in tandem with bonds, equities or public REITs’ returns.

It is highly recommended that investors with low-moderate to medium-high risk profiles include real estate in their portfolios. Given the investment characteristics of private real estate, we believe adding it to a traditional investment portfolio could potentially improve total returns and reduce portfolio risk.

Private real estate can provide significant and important benefits for a mixed-asset investment portfolio. The low or negative correlations of private real estate returns with returns of bonds, equities and public REITs suggest that it can be an effective diversifier, leading to lower volatility of portfolio returns and enhanced returns for a given level of risk. We believe that this is particularly important in an increasingly unpredictable global economy.

We believe that the rationale for investing in private real estate remains stronger than ever and can be briefly summarized as follows:

- Private real estate can deliver attractive and steady returns:

- High total risk-adjusted returns

- Stable income returns

- Partial inflation hedge

- Private real estate provides effective diversification:

- Low or negative correlations with other assets’ return

- Potential to diversify among different real estate markets, property types, investment sizes and strategies

For more information about how you can use private real estate to help diversity your portfolio, contact us today!